Gold, Silver, or Sensex, Which asset class has given better returns in the last five years?

Stock markets, gold, and silver are some of the most preferred investment avenues for Indian investors. Data available from BSE and MCX showed that In the year 2023, Indian equity benchmark BSE Sensex has surged over 8 per cent YTD. While the broader market indices BSE MidCap and BSE SmallCap have given over 20 per cent and 22 per cent return respectively, till Aug 10, 2023. On the other hand, India’s all-time favourite Gold has jumped 8 per cent while Silver has surged over 3 per cent in 2023.

Stock markets, gold, and silver are some of the most preferred investment avenues for Indian investors. Data available from BSE and MCX showed that In the year 2023, Indian equity benchmark BSE Sensex has surged over 8 per cent YTD. While the broader market indices BSE MidCap and BSE SmallCap have given over 20 per cent and 22 per cent return respectively, till Aug 10, 2023. On the other hand, India’s all-time favourite Gold has jumped 8 per cent while Silver has surged over 3 per cent in 2023.

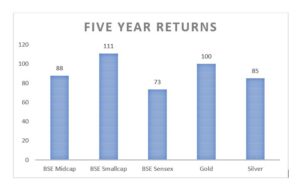

Chasing higher returns often led to riskier investment decisions. However, in a growing economy like India, long-term investments have often yielded good returns for investors. But the biggest dilemma is where to invest, which asset class will provide the highest returns. Here are the details of the last five year’s performance of Equities (Large Cap, Mid Cap, and Small Cap), and precious metals Gold and Silver.

The performance of Indian equities has been very volatile in recent years. Five years ago the equity benchmark BSE Sensex was trading at 37,869 on August 10, 2018. Then during Covid lows, it declined to 25,981 on March 23, 2020. However, now Sensex is scaling new highs as it has jumped 74 per cent in the last five years and currently trading at 65,688 as of Aug 10, 2023.

Similarly, BSE MidCap Index gained 88 per cent to 30,469 on August 10, 2023, from 16,211 five years ago. During the Covid pandemic, the BSE MidCap index declined to a five-year low of 9,711 on March 23, 2020. While BSE SmallCap Index has jumped 111 per cent to 35,398 from 16,784 in five years. BSE SmallCap index declined to 8,873 on March 23, 2020, its lowest point in this duration.

The Spot price for Gold in the last five years has surged 100 per cent to Rs 58,947 per 10 grams on August 10, 2023, from Rs 29,486 on August 10, 2018. Gold touched a five-year high of Rs 61,346 on May 04, 2023 on the other hand its five-year low was Rs 29361 recorded in August 2018.

Silver prices have jumped 85 per cent to Rs 70,111 per kilogram from Rs 37862 in the same duration. The Five year’s peak price for Silver was Rs 76,801 scaled on May 05, 2023. While five years low was Rs 34,867 made on March 17, 2020.

So we can say on a five years period investment in Gold, Silver and Stocks market benchmarks have given almost similar returns, However, volatility was higher in equities.

Just wish to say your article is as surprising The clearness in your post is just cool and i could assume youre an expert on this subject Fine with your permission allow me to grab your RSS feed to keep updated with forthcoming post Thanks a million and please keep up the enjoyable work

This asset is phenomenal. The wonderful information exhibits the proprietor’s earnestness. I’m stunned and anticipate more such mind blowing entries.

This page is extraordinary. The magnificent data uncovers the proprietor’s responsibility. I’m stunned and sit tight for additional such marvelous posts.